(Money Metals Exchange) A rising U.S. dollar is putting downward pressure on precious metals prices this week.

On Thursday, gold and silver markets took a beating under a confluence of adverse forces. In addition to dollar strength versus foreign currencies, trade optimism and rising bond yields drew investors out of precious metals.

As of this Friday, gold is settling lower by $46 or 3.2% for the week to come in at $1,468 per ounce. Silver, meanwhile, re-tested the $17.00 level during Thursday’s selling. The white metal now at $17.02 an ounce and is registering a whopping weekly decline of $1.18 or 6.5%.

Turning to the PGMs, platinum is down similarly to silver, off $60 or 6.3% this week to trade at $894. And palladium is off 3.3% to come in at $1,756 per ounce.

Metals lost some of their safe-haven appeal after China and the United States reportedly reached an agreement to cancel some of the tariffs imposed by both sides in recent months. A ramping down of the trade war was deemed by investors to be good news for the U.S. economy, which has experienced a slowdown in the manufacturing sector.

Investors apparently perceive the risk of a recession to be waning, at least for now. That is being reflected in a steepening yield curve.

Back in August, the yield curve had inverted, meaning some longer-term Treasuries yielded less than shorter-term paper. Much talk about a looming recession followed in the media. One still may be coming. In the past, recessions have occurred several months to a year after an inversion.

Meanwhile, the Federal Reserve has cut short-term rates to try to stave off a recession. It has also committed hundreds of billions of dollars to repo and Treasury bill markets to keep overnight rates from rising above target.

This week, long-term bond yields spiked. The 30-year Treasury saw a yield above 2.4% for the first time since July. The 10-year yield jumped past 1.9% on Thursday in its biggest move since the day after Donald Trump was elected in November 2016.

Interest rate sensitive sectors of the stock market, including real estate and utilities, got clobbered as sector rotation took place. In favor sectors included energy, technology, and cyclicals.

On the plus side for hard asset investors, industrial commodities including copper benefited from the “risk on” trade. Copper prices rose Thursday to a three and half month high.

If you’re bullish on the global economy in general – and perhaps the prospects for Trump’s trade policies boosting U.S. industries in particular – then copper may be a good play.

Rising demand for copper threatens to outweigh its supply. Miners are finding less copper on digs, and low spot prices have deterred development of new copper sources.

This year has seen copper prices make little progress. They have dipped into a trading range, but that trading range is now showing signs of resolving to the upside.

Physical copper can play a relatively small but vital role within a diversified investment portfolio. Like gold and silver, copper has been used in coinage and serves as a store of value over time.

In fact, U.S. pennies minted prior to 1982 are one of the handiest and most straightforward ways to own physical copper, including the lowest cost way to purchase the metal.

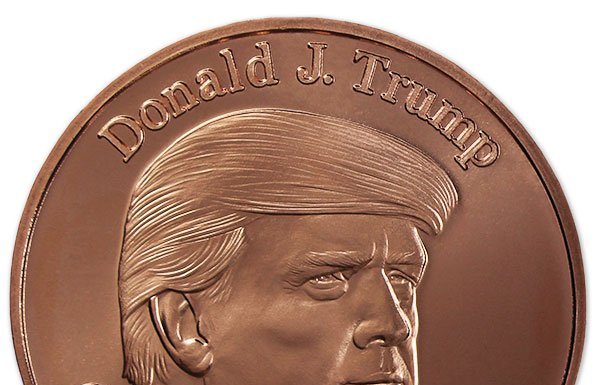

Money Metals Exchange also offers pure copper rounds, including our new copper President Trump round. They are .999 pure copper bullion and commemorate the 45th President of the United States, Donald J. Trump.

Money Metals sells these Trump Copper Rounds in full tubes of 20. They will serve as the perfect gift for anyone who loves our 45th president.

There’s no denying President Trump is one of the more controversial political figures in American history, so this type of commemorative item just may well be in high demand for a long time to come.

We also offer gold and silver Trump rounds in multiple sizes. The 2 Oz Ultra High Relief Pure Silver Round may make the biggest impression.

Of course, if you’re just looking to accumulate bullion while keeping a low profile and not drawing any unwanted negative attention to yourself, you might prefer to opt for a more politically neutral product.

Bullion bars are a plain but efficient way to accumulate any of the metals we offer – from copper to gold, silver, platinum, palladium, and even rhodium. Check out our complete product lineup and take advantage of the recent price dip by going to MoneyMetals.com.