(ZeroHedge) Now that the Fed has effectively nationalized the bond market (don’t worry, stocks are next, it’s just a matter of time) which all the way down through junk bond issues and CLO tranches will no longer reflect the underlying fundamentals but merely what mood the Fed is in on any given day, and where it it tells Blackrock to close the market, the only thing that matters for traders is how to frontrun the Fed.

So to make sure that the Fed’s helicopter paradrop is utilized by everyone in the most efficient way, here is a breakdown of everything the Fed will be buying to make sure the bond prices of fallen angels – firms which spent trillions on stock buybacks instead of even considering a downside case – trade near par even as the underlying cash flows drop near zero…

Putting this together, Goldman estimates that the potential size of the eligible universe of bonds under the revised criteria at $1.8 trillion.

And here is the answer to everyone’s question: with the Fed not yet buying stocks, what is the next best thing to buy in frontrunning the Fed that carries the highest possible return, and the answer of course is junk bond ETFs…

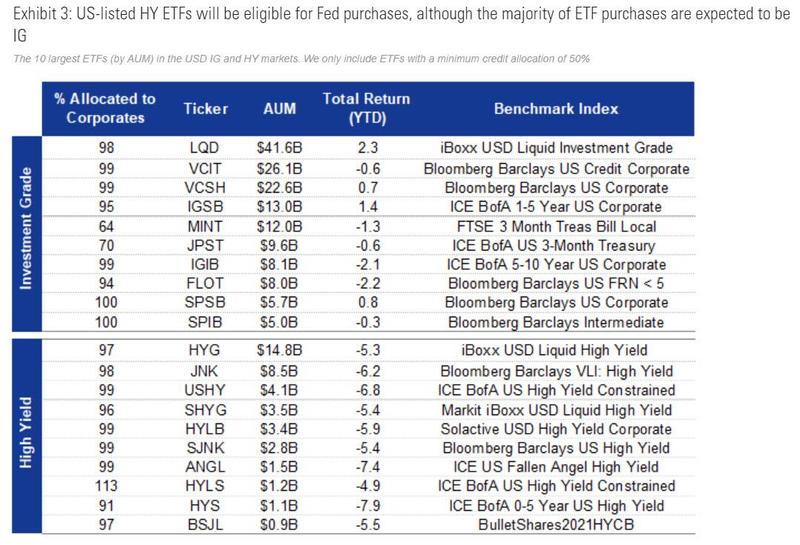

The full list of US-listed investment grade and HY/junk bond ETFs that are eligible for Fed purchases, and which will almost certainly outperform non-Fed backstopped assets, is the following.

Looking at the list above, anything that has a negative total return YTD will put a frown on the Fed’s face, and only disproportional buying of said ETFs – with complete disregard for the underlying fundamentals because there is a reason why these ETFs, mostly consisting of junk bonds issued by private equity portfolio companies operating in the energy sector, got hammered in the first place – will turn the Fed’s frown upside down.