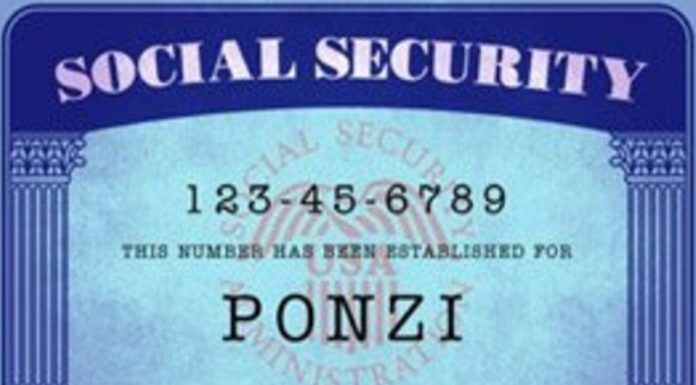

(Stark Realities) At a time when President Biden and congressional Democrats are pushing to expand the breadth of entitlements to include free preschool and subsidized child care, little attention is given to the fact that the country’s biggest existing entitlement program—Social Security—is a financial wreck.

The program’s payouts have exceeded revenue since 2010, but the recent past is nowhere near as grim as the future. According to the latest annual report by Social Security’s trustees, the gap between promised benefits and future payroll tax revenue has reached a staggering $59.8 trillion.

That gap is $6.8 trillion larger than it was just one year earlier. The biggest driver of that move wasn’t Covid-19, but rather a lowering of expected fertility over the coming decades.

That trend has already been steadily undermining the program. In 1960, for every Social Security beneficiary there were 5.1 workers adding payroll taxes to the system. That ratio has shrunk to 2.7 and is expected to reach 2.2 by 2036.

The Social Security trust fund is projected to run out in 2033. Absent other action, that would trigger a 20% cut for everyone receiving benefits at that time.

While 2033 is just 12 years from now, it’s hard to predict when an appropriate sense of crisis will actually take hold in Washington. We can, however, speculate on what measures the inevitable reckoning with the program’s insolvency could include.

First, Congress could look to increase revenue. According to the Social Security trustees’ report, maintaining current benefits would require a major hike of the payroll tax—from 12.4% to 17%.

…

In addition to raising the payroll tax rate, Congress could also expand its reach. Today, it’s applied to incomes up to $142,800. Many Democrats, including Biden, have proposed repealing that cap, either gradually or all at once.

…

In addition to increasing the normal retirement age and raising taxes again, Congress may also consider means-testing—that is, cutting benefits outright for those above certain income levels.

…

There’s another crafty way to cut benefits—for all beneficiaries: Reform architects could put a damper on Social Security’s cost of living increases. With inflation surging, that’s not a possibility to be taken lightly.