(Ryan McMaken, Mises Institute) On Friday, residential real estate brokerage firm Redfin released new data on home prices, showing that prices fell 0.6 percent in February, year over year. According to Redfin’s numbers, this was the first time that home prices actually fell since 2012. The year-over-year drop was pulled down by especially large declines in five markets: Austin (-11%), San Jose, California (-10.9%), Oakland (-10.4%), Sacramento (-7.7%), and Phoenix (-7.3%). According to Redfin, the typical monthly mortgage payment is now at a record high of $2,520.

The Redfin numbers come a few days new numbers from the Case-Shiller home price index showing further slowing in home prices growth since late last year. The market’s expectation December’s the 20-city index had been -0.5 percent, month over month, and 5.8 percent, year over year. But the numbers came in worse (from the seller’s perspective) than was hoped. For December—the most recent monthly data available—the index ended up showing a month-over-month drop of -1.5 percent (seasonally adjusted), and a year-over-year gain of 4.6 percent (not seasonally adjusted).

By most accounts, the rapidly-slowing market faces headwinds thanks to rising interest rates, including the standard 30-year fixed mortgage, which is now back up over 6 percent. This puts homeownership out of reach for many first-time buyers, and is also a big disincentive for current owners to “move-up” into higher priced houses since any new home would come with a much higher mortgage rate than was available a year ago.

Not surprisingly, demand for new mortgages has plummeted. CNBC reported last week:

Mortgage applications to purchase a home dropped 6% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Volume was 44% lower than the same week one year ago, and is now sitting at a 28-year low.

So, sales have fallen and, at least according to Redfin, prices are falling too. This is what we should expect to see in any environment where the real estate market is not being incessantly fueled by easy money from the central bank. After all, easy money for real estate markets had been the main story since 2009.

In recent months, however, the Fed has allowed interest rates to rise while pausing efforts to add more mortgage-backed securities (MBS) to the Fed’s portfolio. Without those key supports from policymakers, the real estate market simply lacks the market demand that is necessary to sustain rapid growth. Contrary to what countless mortgage brokers and real estate agents tell themselves and each other, there is precious little capitalism in real estate markets. It is a market that is thoroughly addicted to, and dependent on, continued stimulus and subsidization from the central bank.

Without the central bank propping up MBS demand in the secondary market, primary-market mortgage lenders have fewer dollars to throw around. That means higher interest rates and fewer eligible buyers. Similarly, by setting a higher target rate for the federal funds rate that banks must pay to manage liquidity, markets face less monetary growth in general. That comes with a lessening overall demand that—in the short term, at least—drives up incomes for both current and potential homebuyers.

Even worse, that continued nominal income growth that does exist is not keeping up with price inflation. The result has been 22 months in a row of negative real wage growth, and that will translate to falling demand.

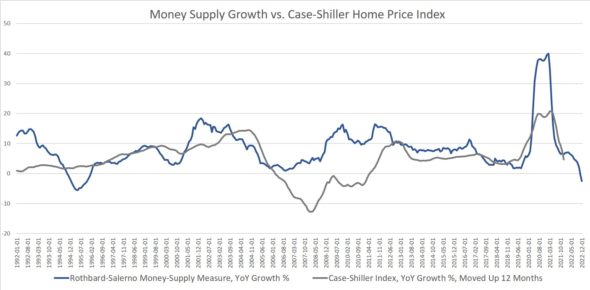

This close connection between easy money and demand for homes can be seen when we compare growth in the Case-Shiller index to growth in the money supply. This has been especially the case since 2009. As the graph shows, once money-supply growth begins to slow, a similar change occurs in home prices one year later.

As money-supply growth rapidly slowed after January 2021, we then saw a similar trend in home prices 12 months later, with a rapid deceleration in the Case-Shiller index. Remarkably, in November of last year, money-supply growth turned negative for the first time since 1994. That points toward continued drops in home prices throughout this year. If Redfin’s February numbers are any indicator, we should expect price growth to turn negative in the Case-Shiller numbers this spring.

Now just image how much more lackluster real estate markets would be without the Fed buying up all those trillions in MBS over the past decade. It’s now been more than a decade since we had any idea what real estate prices actually would be without enormous amounts of stimulus from the Fed. The money-printing-for-mortgages scheme entered its first phase throughout 2009 and 2010, and then was almost non-stop from 2013 to 2022, topping out around $1.7 trillion in 2018. The Fed had begun to pull back on its MBS assets in 2018 and 2019, but of course reversed course in 2020 and engaged in a frenzy of new MBS buying. In that period the Fed purchased an additional $1.4 trillion in MBS. That finally ended (for now) in the fall of 2022. The Fed still holds over $2.6 trillion in MBS assets.

…

For now, though, the investor class remains relatively optimistic. Marcus Millichap CEO Hessam Nadji was on Fox Business last week flogging the now well-worn narrative that we should expect a “small recession,” but Nadji did not even entertain the idea that there might be sizable layoffs. Instead, he suggested that there is now a mere temporary softening of demand, and that will reverse itself once the Fed reverses course and embraces easy money again. In other words, the Fed will time everything perfectly, and it will be a “soft landing.”

This well captures the attitude of the “capitalists” heading the real estate industry right now. It’s all about the Fed.