(Brad Polumbo, Foundation for Economic Education) Congress is currently considering a large increase in federal taxes on cigarette and nicotine products, as part of President Biden’s “Build Back Better” agenda. Yet a new report illustrates why this is such a bad idea.

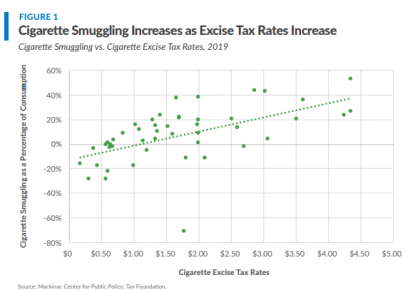

Authored by the nonpartisan Tax Foundation, the study analyzes past cigarette tax increases and shows how they helped fuel the black market. Using data from the Mackinac Center for Public Policy, Tax Foundation expert Ulrik Boesen shows that as these taxes increase, so too do illegal smuggling and black market activity.

There’s plenty of data to examine. The report notes that 39 states and Washington, DC have increased cigarette taxes since 2006. With smoking increasingly unpopular as health risks are more commonly known, smokers—despite being disproportionately low-income—have become an easy target for punitive tax hikes.

Boesen finds that as a result of these tax increases, black market criminal activity has risen in many of the most affected areas. New York, for example, has the highest rate of cigarette smuggling with more than 52 percent of its consumed cigarettes arriving illegally from out of state. Next up is California, with 43 percent of its consumed cigarettes stemming from smuggling operations.

And states like New Hampshire with low taxes on nicotine products see massive amounts of outbound smuggling to nearby high-tax states, Boesen reports. So, too, Oklahoma increased its cigarette tax in 2018 and immediately saw a huge spike in inbound smudging—jumping from 30th to 17th on the list of states with the most smuggled cigarettes.

All in all, there is a clear and strong correlation between tax rates and black market activity, as shown in the graph below:

Suffice it to say this isn’t a good thing. Black markets fuel criminal activity and lack the same accountability and quality standards of free, legal markets. But fueling the black market is just another unintended consequence of big government meddling with legal markets.

“The crafting of tax policy can never be divorced from an understanding of the law of unintended consequences, but it is too often disregarded or misunderstood in political debate,” Boesen concludes.

“Sometimes policies, however well-intentioned, have unintended consequences that outweigh their benefits.”