(Ryan McMaken, Mises Institute) The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data Wednesday, and according to the report, price inflation during April decelerated slightly, coming in at the lowest year-over-year increase in twenty-four months. According to the BLS, Consumer Price Index (CPI) inflation rose 4.9 percent year over year in April before seasonal adjustment. That’s down from March’s year-over-year increase of 5.0 percent, and April is the twenty-sixth month in a row with inflation above the Fed’s arbitrary 2 percent inflation target.

Meanwhile, month-over-month inflation rose 0.4 percent (seasonally adjusted) from March to April. That’s up from March’s month-over-month gain of 0.1 percent.

April’s year-over-year growth rate is down from June’s high of 9.1 percent, which was the highest price inflation rate since 1981. The BLS’s CPI inflation rate has now slowed from June’s high for ten months in a row.

Growth in CPI inflation has indeed slowed, and this reflects slowdowns in energy, gasoline, used cars and trucks. Food prices continued to rise at an alarming rate, but even there, price increases moderated somewhat with “food at home” slowing from a year-over-year increase of 8.4 percent in March to 7.7 percent in April. Prices in energy overall fell 5.1 percent, year over year, with gasoline prices dropping 12.2 percent over the same period.

Shelter prices have seen some of the most robust growth in recent years, and increases have remained among the highest we’ve seen since the 1980s. As of April, however, year-over-year growth in shelter prices slightly slowed as shelter prices increased 8.1 percent in April. That’s down from March’s year-over-year increase of 8.17 percent.

Meanwhile, April was yet another month of declining real wages, and was the twenty-fifth month in a row during which growth in average hourly earnings failed to keep up with CPI growth. According to new BLS employment data released earlier this month, nominal wages grew with hourly earnings increasing 4.4 percent year over year in April. But with price inflation at 4.9 percent, real wages fell.

Moreover, once we look beyond food and energy—the two most volatile components of the CPI—price inflation has barely slowed at all. This so-called “core inflation” rate of increase fell to 5.5 percent in April, but that’s not down much from March’s growth rate of 5.6 percent, or from the 40-year high of 6.6 percent reached last September. Month-to-month increases also remain elevated at 5.5 percent with no sign of core-inflation growth turning negative.

The market’s reaction to this very slight deceleration in price inflation has been to interpret it as a victory over price inflation and to assume that the Fed’s FOMC will now “pause” on interest rate hikes:

“We expect the FOMC to maintain the federal funds rate at its current level for the foreseeable future and for inflation to slow further in the months ahead as supply pressures continue to ease and demand growth weakens,” Wells Fargo’s team of economists wrote on Wednesday.

At last week’s FOMC press conference, Jerome Powell hinted that the committee has taken a dovish turn, announcing that additional rate hikes can no longer be assumed. For what it’s worth however, at least some members of the Committee are maintaining the appearance of continued relative hawkishness. This week, New York Fed President John Williams insisted that “We haven’t said we are done raising rates” and “if additional policy firming is appropriate, we’ll do that. …I do not see in my baseline forecast any reason to cut interest rates this year.”

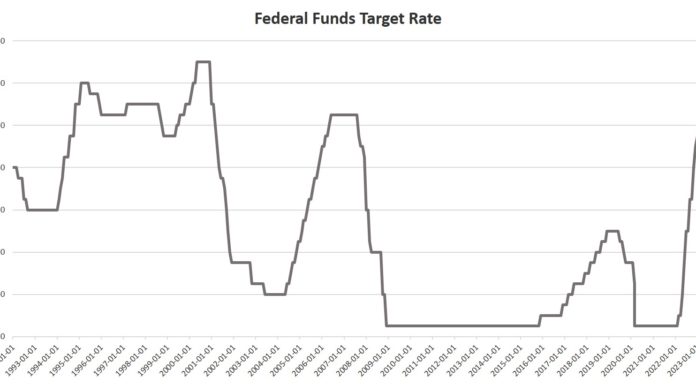

It’s unclear that the Fed has much appetite for additional rate hikes, however. With the FOMC’s latest 25-basis-point hike to 5.25 percent last week, the target federal funds rate is now at the highest it’s been at any time since 2001. The target rate was also at 5.25 percent on the eve of 2008 financial crisis.