(William J. Luther, American Institute for Economic Research) As anticipated, the latest data show that prices continued to rise at an incredible pace in December. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annual rate of 5.6 percent from December 2020 to December 2021.

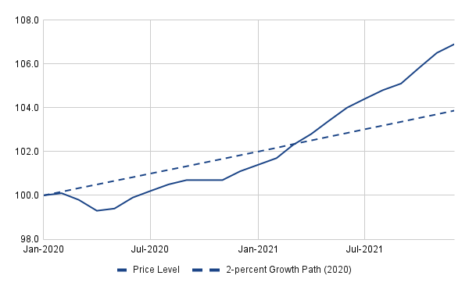

Inflation has averaged 3.5 percent since January 2020, just prior to the pandemic.

The Federal Reserve (Fed) is officially committed to a 2 percent average inflation target, as explained in its Statement on Longer-Run Goals and Monetary Policy Strategy. But supply constraints and a surge in nominal spending have pushed prices well above target. In December, the price level was 3 percentage points higher than it would have been had prices merely grown at 2 percent since January 2020.

The Fed reaffirmed its commitment to a 2 percent average inflation target on January 25, 2022. But, so far, it has done little more than say it would tighten monetary policy in the coming months.

Following last week’s Federal Open Market Committee (FOMC) meeting, the Fed announced it would leave its federal funds rate target and the interest rate it pays on reserve balances unchanged. It will reduce its monthly asset purchases, but the size of the Fed’s balance sheet will continue to grow for now.

None of this really amounts to tighter monetary policy, and yet the Fed seems to have convinced markets that it is serious about bringing down inflation.

Inflation expectations have gradually declined since mid-November. According to my estimates, bond markets were pricing in nearly 3 percent PCEPI inflation per year over the next five years and 2.6 percent per year over the next ten years. Now, they are pricing in around 2.6 percent inflation per year over the next five years, and 2.2 percent per year over the next ten years.

That the most recent estimate over the five-year horizon exceeds that over the ten-year horizon means bond markets expect inflation will decline over time. The FOMC has similarly projected that inflation would decline over the coming years.

However, the precise estimates suggest bond markets currently expect inflation will exceed FOMC projections in the near term. The median FOMC member projected inflation would be 2.6 percent for 2022, and then fall to 2.3 percent in 2023.

At this stage, two things seem pretty clear: Inflation is high and will likely remain above target for a few years.

My own view is that the FOMC is painting a rather rosy picture, and that market expectations provide a better guide for estimating inflation. Even if I am wrong and the Fed delivers on its projections, inflation will likely exceed 2 percent through 2024.

William J. Luther is the Director of AIER’s Sound Money Project and an Associate Professor of Economics at Florida Atlantic University.