(Paul Katzeff, Investors Business Daily) Congratulations! Your retirement planning paid off. You built a $1 million retirement nest egg. But how long will $1 million last in retirement?

The goal for most retirees is simple: Don’t run out of money. A whopping 61% of Americans admit they are more afraid of outliving their money than they are of dying, according to an Allianz Life survey.

So if you’ve worked hard at retirement planning and saving, how do you keep your $1 million from expiring before you do?

Let’s say you’re 65 years old and earn $115,000 a year.

The simple arithmetic answer to the how-long-will-it-last retirement planning question is that your savings would last less than nine years. That’s how many years in a row you can subtract $115,000 from $1 million.

And less than nine years is not very long if you’re healthy and have a normal life expectancy.

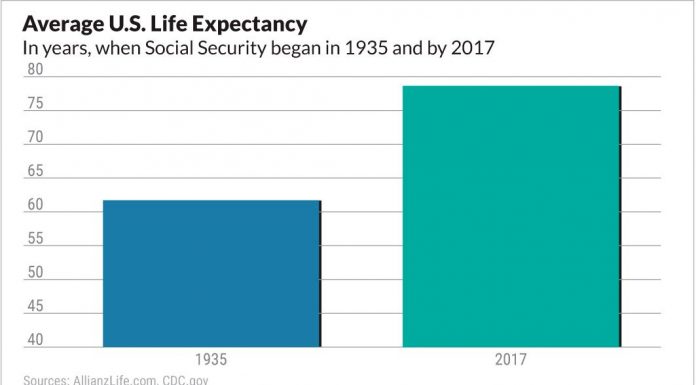

The average American’s life expectancy is now 78.6 years, as of 2017, according to the U.S. Centers for Disease Control (CDC). But for a 65 year old, it’s closer to 20 additional years, according to CDC data.

If you only aim to replace 90% of the non-Social Security portion of your pre-retirement annual income from savings, your portfolio will last more than 22 years if your rate of return averages 8%. [Read more…]