(Clint Siegner, Money Metals News Service) Keeping up appearances is about to get a lot harder for the central planners trying to manage perceptions of the U.S. (and global) economy. The coronavirus is going to have a meaningful impact on global supply chains, even if stock market cheerleaders haven’t fully realized it yet.

This might be because the corporate media and ruling elites are burning a lot of what is left of their fading credibility trying to ignore or downplay the problem.

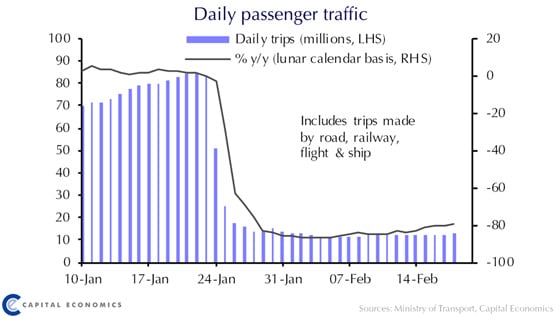

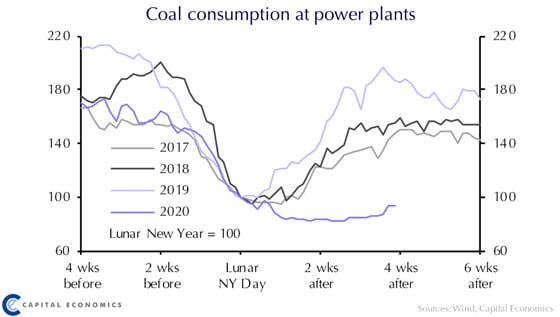

Some things can’t be ignored, however. Capital Economics published some telling charts last week showing conditions on the ground in China. Below are two which detail the Chinese economy all but grinding to a halt.

Bloomberg reported a 92% drop in Chinese car sales during the first half of February.

And Maersk, the world’s largest container shipping company, warned that the coronavirus will have a big impact on earnings. The company reported Chinese factories are operating at 50-60% of capacity.

That is very bad news to pile on top of the company’s already dismal performance. Maersk reported a loss in the 4th quarter, before the impact of the virus.

CNBC pundits can talk all they want, but what is happening in China will soon be felt around the world. Americans will find out what is real when many of the shelves in the local Walmart start looking a little bare.

If the virus is not contained quickly and factories remain closed, the supply chain could completely break down for merchants selling Chinese goods.

Managing perceptions may get harder, but that doesn’t mean the Federal Reserve won’t try. Christopher Irons of Quoth the Raven Research summed it up nicely on Twitter:

The year is 2023…

The coronavirus has wiped out humankind…

A lone server in the basement of the NY Fed building continues to bid the Dow Jones to new all-time highs.

Shares of Walmart were up about 1.5% since the World Health Organization declared the coronavirus to be a “public health emergency of international concern” on January 30th. The broader S&P 500 index enjoyed a similar bump following the news, until today that is.

Could it be that investors think central banks will look at the coronavirus news as an excuse to ramp up stimulus?

They may be right, but no amount of printed money is can put merchandise on store shelves.