(Brad Polumbo, Foundation for Economic Education) For many people, the start of a new year is an opportunity for genuine self-reflection. If Democratic lawmakers take an honest look at 2021, the inescapable conclusion is that voters chose with their feet — and rejected high taxes.

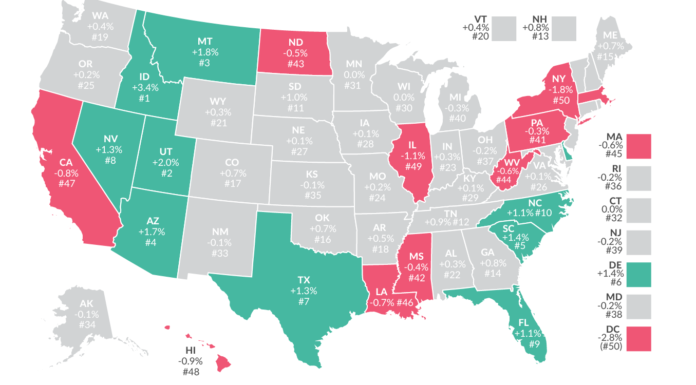

A new analysis from the right-leaning Tax Foundation reaches this conclusion. Analyst Jared Walczak broke down U.S. Census Bureau data and reports that while the United States overall saw only minor population growth in 2021, there were very significant shifts in state populations as people relocated.

The five states (counting Washington, D.C., for analysis purposes) that lost the most residents on net were Washington, D.C., New York, Illinois, Hawaii, and California. Meanwhile, the states that saw the biggest net gains in population were Idaho, Utah, Montana, Arizona, South Carolina, Delaware, Texas, Nevada, Florida, and North Carolina.

Notice a pattern? The states with population losses tend to be higher-tax states, while those that saw an influx of new residents tend to be lower-tax states.

This isn’t just intuition — Walczak ran the numbers. Analyzing data covering April 2020 to July 2021 and including the district, the analysis concludes that in the bottom third of states (the ones with the biggest population declines), the average combined state and local top tax rate is 7.3%. In stark contrast, in the top-third of states (the ones with the most population growth), the combined tax rate is just 3.5%.

The trend here is clear as day. When voters put their money on the line, they chose lower-tax states and rejected high-tax, blue-state policies.

“People move for many reasons,” Walczak said. “Sometimes taxes are expressly part of the calculation. Often they play an indirect role by contributing to a broadly favorable economic environment. And sometimes, of course, they play little or no role. The Census data and these industry studies cannot tell us exactly why each person moved, but there is no denying a very strong correlation between low-tax, low-cost states and population growth.”

Don’t be surprised if some progressive politicians, who love to spend (and waste) our money, try to deny it anyway and stick with their bad tax policies. But the truth is clear to any honest observer. Yet, there’s more than just a lesson on tax policy here.

This trend toward lower taxes and freer economies reminds us why the U.S. system of federalism — decentralized governance — is so effective and worth preserving. When Americans can choose between different policies at the state and local level, more people get to live under policies that embody their values. And, more importantly, the best ideas win out over time.

When the federal government enacts one-size-fits-all policies on the entire country, this opportunity for customization and experimentation is lost.

[Source]